Due Diligence reveals liabilities of 1.35 billion euros in March 2021 and increases by 61% in payroll in 3 years, 56% in administrative costs and 600% in financial costs

- label.aria.viber Viber

- label.aria.whatsapp WhatsApp

- label.aria.twitter Twitter

- label.aria.facebook Facebook

- label.aria.messenger Messenger

- label.aria.link label.aria.tick Copy link

In April 2021, FC Barcelona commissioned a Financial Due Diligence to Deloitte (one of the world’s leading professional services firms), with the aim of analysing the club’s results during the 2018/19 and 2019/20 seasons and the first nine months of the 2020/21 season, as well as to obtain details of the club’s economic and financial situation at the time when the new Board of Directors took office following election by the members last March 7th.

The CEO of FC Barcelona, Ferran Reverter, has today publicly presented to the media the details of that Due Diligence, which conclude that there have been serious administrative deficiencies, and has also presented the closure of accounts for the 2020/21 season, which will be put to a vote at the next Ordinary General Assembly on 17 October.

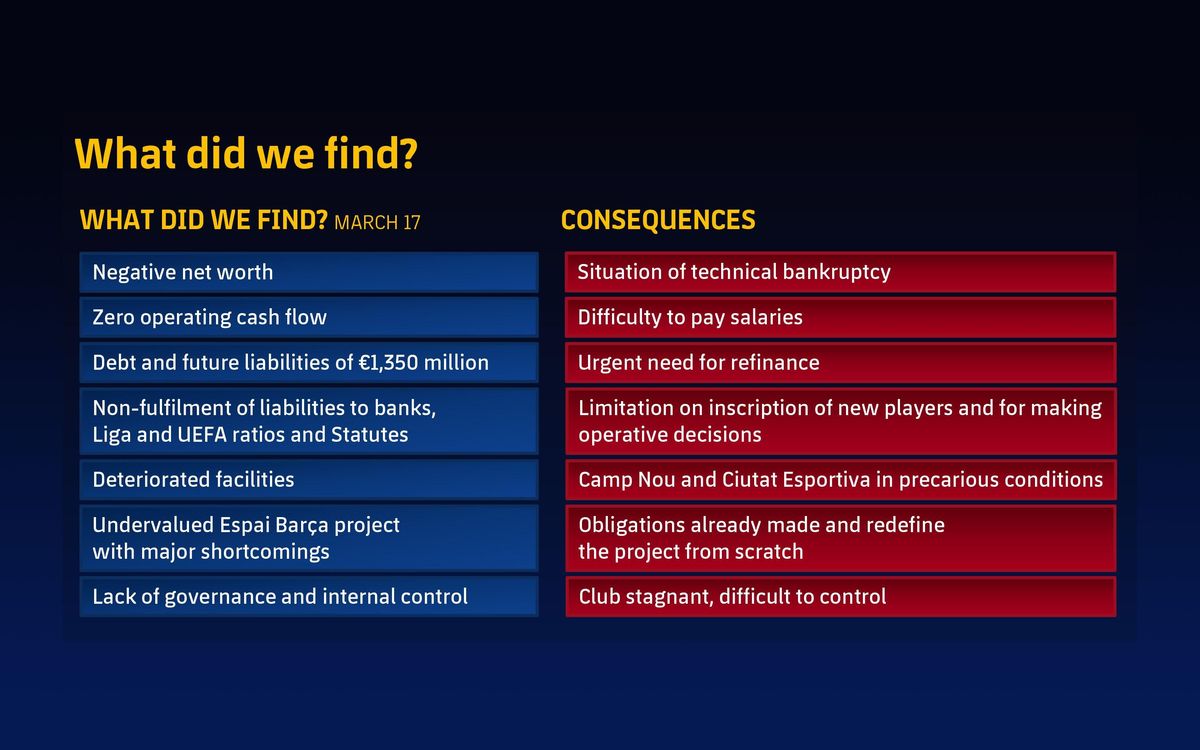

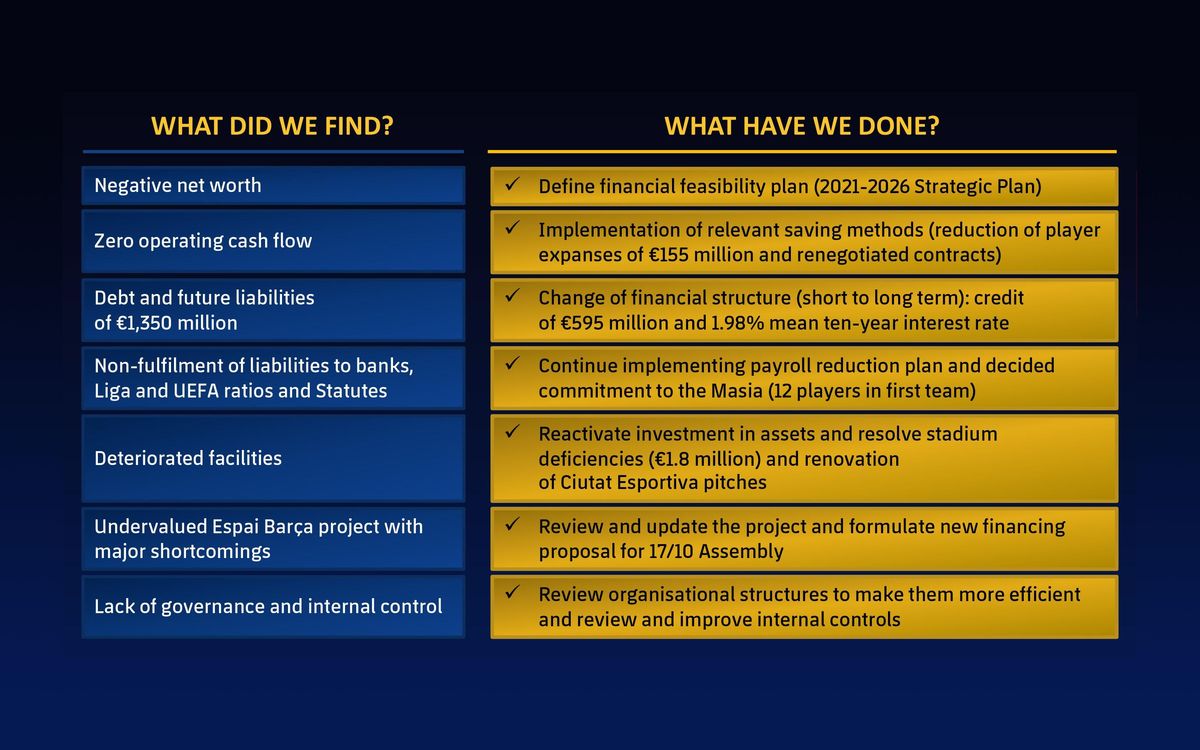

The new Board of Directors and its new executive structure encountered an economic and financial situation marked by negative equity and in a situation of technical bankruptcy; debt and future liabilities amounting to 1.35 billion euros, with an urgent need for refinancing; zero operating cash flow, with difficulty to meet the payroll; widespread non-compliance with financial ratios, limiting the registration of new players and decision-making; deteriorated facilities and a Camp Nou in a precarious situation; an undervalued Espai Barça project with serious shortcomings; and a lack of governance and internal control, which made it difficult to control and manage the institution.

Gradual deterioration of economic results

The results for the last five seasons (from 2016/17 to 17 March 2020/21) reflect a gradual reduction in net income and operating cash flow. These results were impacted by non-recurring operations, such as extraordinary player sales, player exchange operations and the impact of Covid-19.

Excluding these non-recurring impacts, the economic results of the last five seasons would have been negative. The main aspects that have given rise to these results are the following:

1. A 61% increase in the payroll caused by new signings and player renewals. The signings were made at high prices and by signing contracts that included new remuneration concepts such as loyalty bonuses and end-of-contract premiums that increase future spending. If the same squad had been kept in this 2021/22 season, the payroll would have amounted to 835 million, 108% over recurring revenue. Moreover, these operations have resulted in significant and unusual intermediation costs in previous years.

2. A 56% increase in administrative expenses between the 2016/17 and 2019/20 seasons due to a lack of governance and management.

3. Between the 2016/17 and 2019/20 seasons, the financial costs were multiplied six-fold due to the increase in net debt and the lack of financial planning.

4. The impact of Covid-19 caused losses of 43 million in the 2019/20 season and 65 million during the first nine months of the 2020/21 financial year. Therefore, without the impact of Covid-19, the results would have been equally negative in both years.

Significant increase in debt

From June 2018 to March 2021, the club’s net financial debt increased by 514 million (from 159 in June 2018 to 673 million in March 2021), due to the net investment made in the purchase and sale of players, amounting to 306 million; in the work on Espai Barça, for a cost of 92 million; other investments in operating assets, amounting to 45 million; and the increase in financial costs, for a total of 71 million. The club has not been able to generate a positive operating flow throughout these three years, and therefore all other sections have had to be paid by increasing the third party debt.

This increase in debt has been made without requesting authorisation from the General Assembly of Members, for various amounts below the statutory limit. Moreover, the club’s financial situation, both in June 2020 and in March 2021, has meant non-compliance with liabilities with banks and the ratios required by financial institutions, La Liga, UEFA and the club’s own statutes.

As well as the increase in debt, there are other miscellaneous liabilities and commitments that have been assumed by the club and that are not recognised in the official calculation of the debt, which amounted to 1.35 billion euros in March 2021. Prominent among these are the deferral of player salaries, amounting to 389 million (147 deferred in the 2020/21 season by the collective board and 238 in the form of loyalty bonuses, signing bonuses and end-of-contract bonuses); ongoing lawsuits with probable risk, for a total of 91 million (the club also has ongoing lawsuits considered possible or remote risk for 321 million); liabilities related to Espai Barça, for an amount of 56 million; and, finally, anticipated income from part of the audiovisual rights for next season, worth 79 million.

The repayment schedule for these liabilities makes it patently clear that between March 2021 and June 2022, the club will have to deal with payments amounting to 470 million, 35% of the total debt.

Economic measures

The main actions promoted in recent months by the new Board of Directors to resolve the club’s current financial situation have been the following:

- Obtainment of a temporary loan of 80 million euros to cover the treasury obligations for a period of 90 days; and the negotiation of temporary waivers with the main financers.

- In relation to the previous point, with the aim of restructuring the club’s debt, a refinancing operation valued at 595 million euros was negotiated and signed in August 2021 to meet short-term commitments with a series of American entities, which has made it possible to significantly reduce the average cost of the club’s financial expenditure. In order to achieve this, last September the club obtained a so-called ‘Negative BBB Rating’, a rating that was good news for the club, as it supported the economic project and was an essential step towards being able to close the refinancing operation, which has been done with an average ten-year interest rate of 1.98%.

- Renegotiation of the conditions and terms of the current loan associated to Espai Barça, pending the submission of the final financing structure for approval by the Assembly of Delegate Members on 17 October. In parallel, the club has undertaken a comprehensive review of the project, noting that it had become obsolete and undervalued, and had serious shortcomings. The club is working on improving the project, taking advantage of all of its previous strengths and modifying those aspects that required changes on an architectural or organisational level.

- A new 2021-2026 Strategic Plan has been drafted based on increasing the club’s revenue, establishing control of sporting and administrative payrolls, and achieving a stable economic-financial situation. In this new business plan, the club is seeking to lay the new foundations for the right kind of sports model by applying a plan to reduce the current payroll, which has already begun to be applied this summer with a reduction in the men’s first team payroll by about 155 million euros.

- The club has made a firm commitment to the dejudicialisation of the Club, reducing the lawsuits currently in courts in all jurisdictions and having reached beneficial agreements for FC Barcelona, in order to resolve the maximum number of disputes amicably.

- The club has performed a multidisciplinary review of the current situation of the premises, making an urgent and necessary investment of about 2 million euros to resolve structural deficiencies in the stadium that meant members would not be able to return following the lifting of crowd restrictions due to the pandemic.

- All organisational structures are being reviewed to make them more efficient and internal controls are being reviewed and improved so that they cannot be circumvented again.

- In addition to the Due Diligence, a Forensic research study has been commissioned with the aim of detecting possible irregularities in the management of the club.

- label.aria.viber Viber

- label.aria.whatsapp WhatsApp

- label.aria.twitter Twitter

- label.aria.facebook Facebook

- label.aria.messenger Messenger

- label.aria.link label.aria.tick Copy link